Ripple Wiki ▷ What is XRP? Cryptocurrency & more!

Our Ripple Guide aims to give you completely unbiased information about the Ripple XRP Token so that you can make an accurate valuation of your investment. We'll also show you how to buy XRP, but as always, we advise you to exercise caution before investing in any cryptocurrency, and encourage you to do extensive research before investing your money.

Summary

- Ripple is an open payment network in which the XRP token is transferred. Ripple's unique advantage over many competing cryptocurrencies is that it tries to work with the current financial system.

- The Ripple network solves problems in the traditional banking system such as slow transaction times (certain payments can take up to five days to process). Banks also spend $ 1,6 trillion a year in interbank transaction fees, while Ripple can do so at a fraction of the cost.

- XRP is the most centralized cryptocurrency. It is not an investment for people who believe in decentralization. 60% of the total token offering is held by Ripple itself, which means that Ripple has massive control over the price of XRP. Ripple's control of their network means they also have the option to freeze transactions and user funds.

- Ripple has an impressive list of partners including names like American Express, Santander, Standard Chartered, UBS, and many more.

- At the moment it has not applicable Required by Ripple's partners to use the XRP token. It remains to be seen whether banks and credit card companies will actually use XRP.

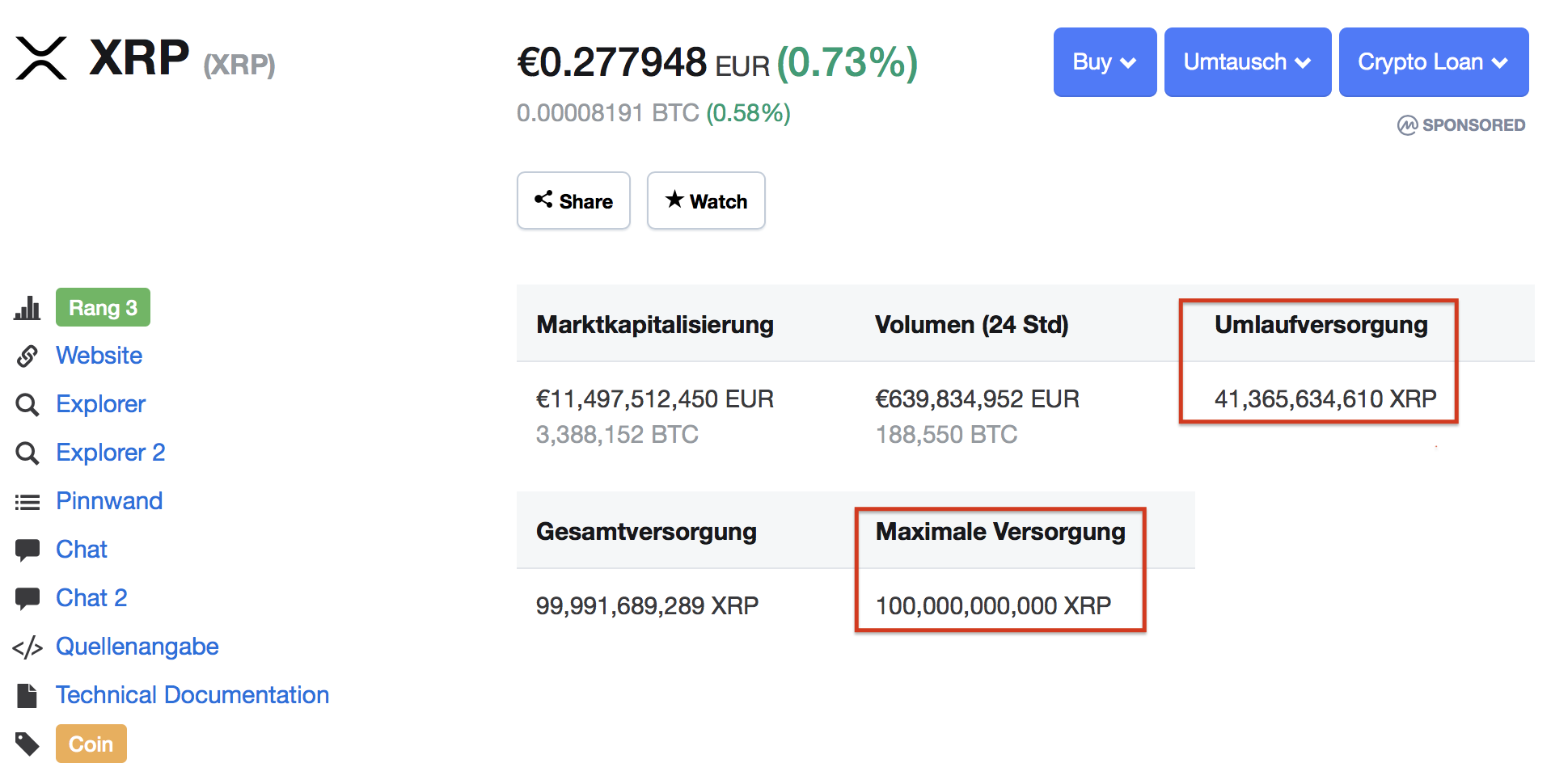

- The total maximum supply of XRP is 100 billion. This means that in exceptional cases the value of the token does not match that of Bitcoin will achieve. If the token was worth $ 10 and the entire supply of XRP was in circulation, it would result in a market cap of $ XNUMX trillion for XRP.

What is Ripple anyway?

The Ripple token is also known as XRP and is transmitted within Ripple's open payment network. Ripple's ultimate goal is to create a global network of financial institutions in order to reduce transaction costs and increase the speed at which money flows around the world. The network is also intended to serve as a liquidity pool for banks.

In addition, Ripple wants a solution for two main problems that plague today's financial networks:

- Extremely high transaction fees in financial networks such as credit cards, bank transfers and e-wallets.

- Improvement of the transaction speed. Currently, bank transactions can take up to five days while on the Ripple network maximum 3 seconds take.

XRP is the fastest, cheapest, and most scalable cryptocurrency currently available.

Ripple is meant to be used by bank payment providers, corporations, and exchanges to save them money. This is different from cryptocurrencies like Bitcoin, which were intended for human use.

Globally, we process over $ 155 trillion annually and there is no doubt that the current payments infrastructure needs to be updated. Ripple tries to be the much needed update to the global payments infrastructure.

Partnerships with traditional companies

The Ripple network has tremendous potential to cut transaction costs for banks, credit card companies, and e-wallet companies to save them $ 100 million a year. Ripple offers an undeniably drastic improvement in transaction speeds of up to 3 seconds compared to the 5 days it can currently take in traditional banking. But unfortunately stay two main problems consist:

- Big companies like Santander and American Express convince that Fiat currency to replace and use the XRP token. If XRP is never adopted, then it has no value.

- Bitcoin News.one has reached out to the world's largest financial institutions, and the difficulty is that financial giants are slow to embrace change; large, multinational corporations are not encouraged to modernize systems. Why would a board member take the massive risk of driving new technology adoption, especially when the status quo allows them to collect the heavy fees that fund their bonuses? The long-term benefits of technology adaptation for customers appear to be sacrificed for short-term stability and profit margins for companies.

Can these big corporations really be that out of date? The answer is yes. For example, have you ever wondered why you are asked several times for the same information, such as your address, when opening a bank account? The reason for this is that the banks do not have a central system to keep track of customers and accounts. Instead, current deficiencies in the system are corrected with small repairs in order to save costs, even if this only makes the system more cumbersome.

In our highly centralized world, Ripple's strong centralization may make it more likely that it will be adopted by major financial firms. As much as we would like the introduction of this technology, we at Bitcoin-News.one suspect that the introduction of XRP will take longer than many expect. Ultimately, there is too much money to be saved by financial institutions to ignore XRP indefinitely. Whether these institutes then pass on savings to the customer or simply increase their profit is another question.

How does Ripple fit into the financial system?

Ripple offers a great opportunity to completely modernize the global transaction infrastructure.

Unlike many other startups, Ripple is not only a great idea but also has a very well-rated product. You have a working product and a list of over 100 partners in the financial industry. Partners like American Express are well known names and have an enormous global presence. A single acquisition from a partner of this size would likely result in additional partnerships for Ripple.

The RippleNet makes it cheaper and faster for any company moving large amounts of money across borders. Pretty much any publicly traded company could benefit from an acquisition. This illustrates the size of the market that Ripple is trying to get a piece of.

The Ripple network also acts as a currency exchange between all forms of fiat. In order for the exchange to work, there must be liquidity and that is the use case for the XRP token. The XRP token is used as an intermediate value that is exchanged between financial institutions on the network. These tokens can then be converted back into the currency desired by the institution. The XRP can either be held or used for other cross-border payments, such as paying a supplier.

Unfortunately, the average worker is unlikely to get much of a boost from the introduction of Ripple. The infrastructure is geared towards large institutions and we doubt that you personally will be able to make quick and super cheap transactions. However, if the Ripple project is successful, it will completely modernize the way cross-border payments are processed.

Is Ripple Centralized?

Centralization is defined as:

"the concentration of control over an activity or company under a single authority."

In the cryptocurrency community, centralization is widely seen as a bad thing. Why? Because with control comes power. As Lord Acton once said: "Power tends to corrupt and absolute power absolutely corrupts". Can a person or institution in power be trusted to be fair and not abuse a power to serve their own agenda?

There are maximum 100 billion XRP in the delivery chain, but only 39 billion are in circulation. With that, Ripple Labs holds the remaining 61 billion XRP. It is safe to say that with its massive holdings, Ripple has significant control over the XRP token. The biggest fear among crypto enthusiasts is Ripple's potential to sell all 61 billion of its XRP tokens at once. It could certainly crash the market and hurt anyone who has invested in the token.

The difference between max intake and circulating intake is the amount of XRP that Ripple Labs holds.

With this, Ripple Labs have taken steps to build trust in the community. They announced in May 2017 that 55 billion XRP would be placed in escrow accounts. That means investors can now mathematically check the maximum supply of XRP that can enter the market. We see this increase in certainty as very good for XRP investors.

Would Ripple (XRP) be a good investment?

Only you can decide whether or not to invest in XRP. But we can give you our opinion.

Benefits

- Unlike other cryptocurrencies, we think Ripple is very well positioned in the work product, use case and partnerships categories.

- It is also very positive that the company is already posting real revenue.

- XRP is intended for collaboration with the current players in the financial system. So it is unlikely that many financial institutions have any real incentive to destroy Ripple.

Disadvantages

- However, it is still questionable whether the XRP token will actually be widely accepted by financial institutions.

- The 61 billion XRP tokens that are still to be released will be integrated into the cycle and thus doubled.

- Ripple is still much more centralized than other cryptocurrencies. It all depends on the individual opinion - whether you think that this is a good thing for such a product and what goals can be achieved with it or what limitations it brings with it.

XRP investors

Ripple has some important supporters from the non-crypto world such as: GoogleVentures, Accenture, Santander InnoVentures, Andreessen Horowitz and more.

The support of large companies like this one will be critical to the realization of Ripple's vision and fortunately these donors have invested financially and are motivated to make the Ripple project a success. We think that's very good as an additional investment case.

How to Buy Ripple

We have this one comprehensive guide put together how to buy XRP using a variety of methods and exchanges.

Conclusion

When it comes to cryptocurrency, we think of Bitcoin News.onethat there are few viable projects that can actually challenge the old financial system. Ripple appears to be a legitimate competitor and has the potential to completely modernize cross-border transactions.

Ripple developed the technology that enables financial institutions to achieve significant cost savings and efficiency gains. This explains the more than 100 partnerships with, for example, American Express and the strategic investment of companies such as Google Ventures. It remains to be seen whether the XRP token will actually be used by the old financial world.

When you invest in XRP, there is no real everyday use case. The intended function is aimed at large financial institutions. However, XRP gives cryptocurrency investors the opportunity to profit when XRP is adopted as the new global payments infrastructure.